Business Insurance in and around Millersville

Get your Millersville business covered, right here!

Cover all the bases for your small business

State Farm Understands Small Businesses.

Small business owners like you have a lot on your plate. From inventory manager to HR supervisor, you do whatever is needed each day to make your business a success. Are you an insurance agent, a dentist or an HVAC contractor? Do you own a clothing store, a camera store or a deli? Whatever you do, State Farm may have small business insurance to cover it.

Get your Millersville business covered, right here!

Cover all the bases for your small business

Keep Your Business Secure

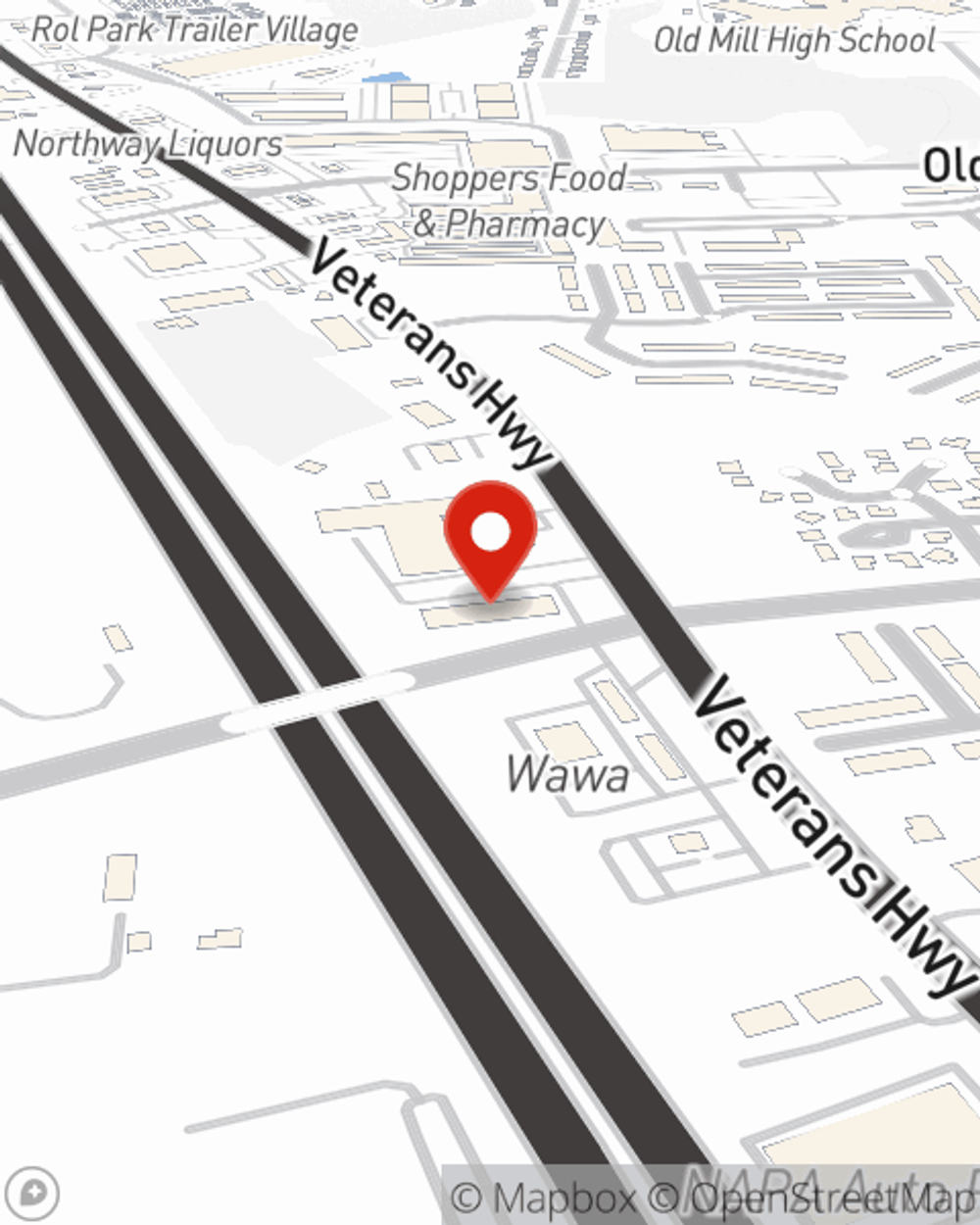

Each business is unique and faces specific challenges. Whether you are growing a meat or seafood market or a janitorial service, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your location, you may need more than just business property insurance. State Farm Agent Nancy Arias can help with extra liability coverage as well as mobile property insurance.

Let's review your business! Call Nancy Arias today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Nancy Arias

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.